Over the years, the evolution of Industry 4.0 has brought an enormous amount of used but in excellent condition industrial equipment onto the market, opening up new opportunities for companies keen to stay at the cutting edge at lower costs.

However, in 2023, changes in legislation have shifted the landscape of machinery purchases. The recent Budget Law 2023 (Law No. 197 of December 29, 2022, Art. 1, Paragraph 423) has introduced significant modifications, reducing benefits for those investing in new equipment.

The deadline for the delivery of new tangible instrumental goods 4.0 (listed in Annex A to Law 232/2016) ordered by December 31, 2022, has been extended from June 30, 2023, to November 30, 2023. For non-instrumental goods, the deadline remains June 30, 2023.

The tax credit percentages are 40% up to 2.5 million, 20% up to 10 million, and 10% over 10 million and up to 20 million for deliveries by November 30, 2023 (Note: with a 20% down payment on the asset paid by December 31, 2022). These detrimental changes, especially for assets up to 2.5 million euros, will likely impact SMEs that often make purchases in this range.

Furthermore, the maximum allowable investments for each time period have been reduced.

Additionally, super-amortization becomes a tax credit, calculated directly as a percentage of the acquisition cost of the asset.

For more details on the percentage of the asset cost and the investment ceiling for each facilitative period, refer to this link from the Revenue Agency, dedicated to Law December 11, 2016, No. 232 (Budget Law 2017).

WARNING! In the non-updated Agency article, from 2023, the tax credit is halved (20% – 10% – 5%) with a decreasing logic based on the amount invested.

The facilitation measure varies depending on the type of investment:

- For tangible assets “Transition 4.0” functional to the technological and digital transformation of companies (Annex A to Law No. 232/2016), the tax credit is 40% of the cost for investments up to 2.5 million euros, 20% of the cost for the investment portion exceeding 2.5 million euros and up to 10 million euros, and 10% of the cost for the investment portion exceeding 10 million euros and up to the maximum limit of overall admissible costs of 20 million euros. For leasing investments, consider the cost incurred by the lessor for the purchase of assets.

- For intangible assets connected to investments in tangible assets “Transition 4.0” (Annex B to Law No. 232/2016), the tax credit is 20%, within the annual maximum limit of 1 million euros in allowable costs.

- For assets other than those mentioned above, the tax credit is 6% of the cost, determined in accordance with Article 110, paragraph 1, letter b), of the Tuir, within the ceiling of 2 million allowable costs for tangible instrumental assets and the ceiling of 1 million allowable costs for intangible instrumental assets. For leasing investments, consider the cost incurred by the lessor for the purchase of assets.

The tax credit can only be used for offsetting, in three equal annual installments.

Utilization can start from:

- The year of commissioning of the assets for investments in assets other than “Transition 4.0”

- The year of interconnection of the assets to the company’s production management system or the supply network for investments in “Transition 4.0” assets.

Point Mach and its mission.

As you understand, the regulatory and bureaucratic landscape is constantly evolving and can often pose challenges for companies.

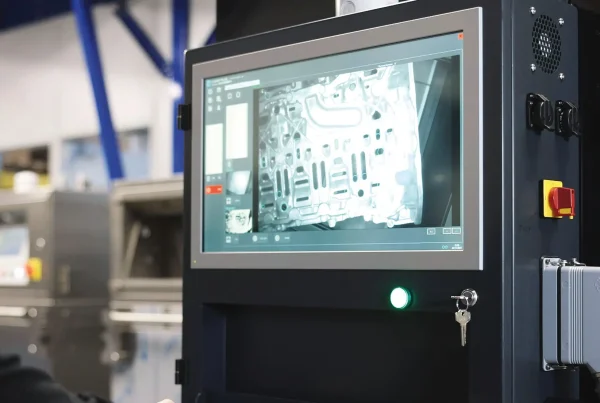

For this reason, our platform provides a strategic alternative for businesses looking to save without compromising quality. With the decrease in incentives for new machinery purchases, the used industrial market could see a significant increase in demand.

Our network is ready to facilitate this transition, connecting buyers and sellers in an environment that promotes sustainability, efficiency, and above all, trust between parties!

The legislative change can be seen as an opportunity to redefine the perception of used industrial equipment. With our support, businesses can fully capitalize on what Industry 4.0 leaves behind, optimizing investments and contributing to the sustainability of the manufacturing sector, especially for new ventures that often lack substantial budgets.

Our mission is to guide this transition into a future where circularity and efficiency define business success.