The European Commission has finally given the green light to the proposed modification of the National Recovery and Resilience Plan (PNRR), integrating RePowerEU with a funding of $6.3 billion for the biennium 2024-2025. These funds will be dedicated to the brand-new Transition Plan 5.0, complementing the existing Transition Plan 4.0.

What does “5.0” mean?

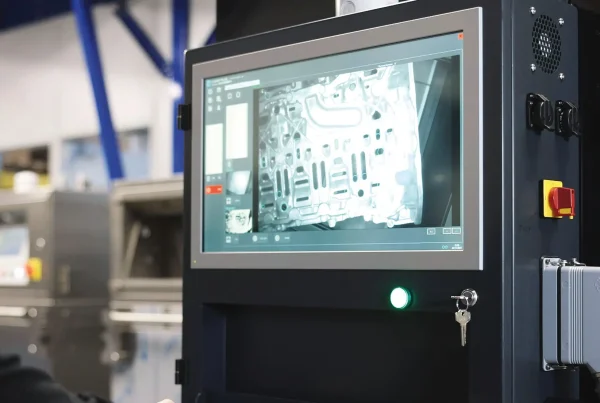

While Transition 4.0 involves the adoption of advanced technologies such as artificial intelligence, cloud computing, the internet of things, robotics, and blockchain, enhancing the efficiency, quality, and competitiveness of production processes; Transition 5.0 represents a bold vision, shifting from a linear development model based on fossil fuels to a circular paradigm guided by renewable sources. This approach aims to promote recycling, reuse, and resource regeneration, with the goal of propelling the industry towards a sustainable and human-centered future.

The Transition Plan 5.0 consists of three distinct modules: energy efficiency, self-consumption, and training. Focusing on energy efficiency in production processes, it offers tax credits with increasing rates based on energy improvement objectives. Expenses related to personnel training for ecological transition skills are deductible, with a limit of 5% of the total facilitated investment.

What are the requirements?

To benefit from tax credits, Transition Plan 5.0 and related expenses must be incurred between January 1, 2024, and December 31, 2025, for businesses choosing to invest in one of these three activities:

- Purchase of 4.0 instrumental assets, both tangible and intangible.

- Acquisition of assets necessary for self-production and self-consumption from renewable sources (excluding biomass).

- Expenses for personnel training in ecological transition skills.

These activities must yield measurable results in terms of energy efficiency or energy savings, and the intensity of the fiscal benefit will increase based on the improvements achieved.

How much will the tax credits amount to?

The new package of 5.0 tax credits will be enacted with the 2024 Budget Law and will have a retroactive effect, including investments made in the last months of 2023, approximately from the coming fall. It is presumed that they will be in line with those introduced for 4.0. Notably, grants for personnel training are absent, as they have not been renewed in the current year.

For details on 4.0 tax credits, please refer to the previously written article outlining the changes introduced by the recent budget law.

For further information, consult your tax advisor.